Social Security and Inflation

How inflation rate affects Social Security benefit calculations.

November 23, 2018

Many people know that the inflation rate reduces the real value of their savings every year. For example, using CPI data, $1 had the same spending power in year 1950 as $7.13 did in year 2000. Therefore, when considering social security benefits over multiple decades, it is worth understanding how the inflation index will impact those benefits.

The short answer is that the Social Security program is designed to account for inflation, as is this site's social security calculator tool. The benefit estimates that the Social Security Administration and this tool will give you are in "today's dollars" meaning that the actual benefits will be higher to match the increase in inflation between today and the benefit date, but will have the same purchasing power at that time as the estimate has today.

For example, if this tool estimates your benefit at $1,000 per year starting in 20 years, but there is 350% inflation during those 20 years, then the actual benefit will be $3,500 ($1,000 x 350%).

If you want to understand this in even more detail, read on below to understand how different measures of inflation affect different parts of the social security computation.

Wage Growth Adjustments during your working years

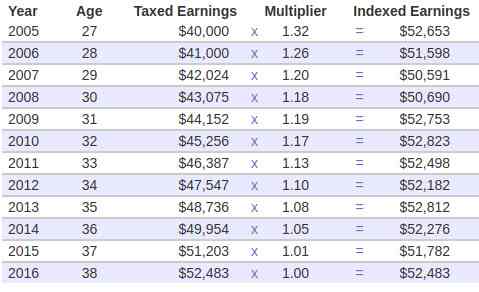

Consider the following example earnings record from 2005 to 2017:

This person receives a 2.5% raise every year to keep up with inflation. In 2005, they earned $40,000 and in 2016 they earned $56,483, a 31.2% increase.

The "Primary Insurance Amount" for this person, which is the earnings computation upon which their benefit is based, is computed from the rightmost column, labelled Indexed Earnings. Note that the indexed earnings value in 2005 is roughly the same as in 2016.

This difference in Indexed Earnings is because of the multiplier applied. That multiplier is 1.32 in 2005, representing the fact that there has been ~32% inflation between 2005 and 2016. As such, older earnings records get adjusted upwards for inflation. Every year until you first collect your benefit, the multiplier for all previous years will be adjusted upwards further.

This adjustment is made based on the Average Wage Index (AWI). That is, if the average wage increased by 3% in a year, so will the Average Wage Index and thus all of the prior year's indexed earnings values.

The Social Security Administration maintains estimated (a guess) indexing factors for future years. You can see the estimates here and calculate your estimated indexing factors based on your year of eligibility here. If you don't know which year you are eligible for benefits, use the social security calculator tool to compute it.

Cost of Living Adjustments during your benefit years

Once you have filed for your benefit, you no longer receive additional Wage Growth Adjustments. At this point, your Primary Insurance amount, and thus your benefit, are adjusted annually by Cost of Living Adjustments.

These adjustments are based on the Consumer Price Index (CPI-W). Every year, benefits are increased by a few percent. There has never been a decrease, but there have been years with no increase when there was little to no actual inflation.

Future Cost of Living Adjustments are not shown in the social security calculator tool since the actual adjustment value won't be known until the future. Therefore any benefits shown by this calculator are displayed in "today's dollars".