Federal Taxation of Social Security Benefits

Published: 12/4/2022

As Americans, we all know that paying taxes is an important part of our civic duty and a crucial way to support the programs and services provided by our government. But when it comes to taxes and social security benefits, many of us are unsure of how these two things work together and how they impact our finances. This comprehensive guide will help you understand the basics of federal taxes and social security benefits, and provide you with the information you need to make informed decisions about your own taxes and benefits.

State Taxes

Your Social Security benefits can be taxed at both the state and federal levels. The laws differ between each state. This guide does not cover the state tax rules, but does explain how Social Security benefits can be taxed federally. If you live in one of the following 38 states, you are in luck, as the state does not tax Social Security benefits at all:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Mississippi

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Sourch Carolina

- South Dakota

- Tennessee

- Texas

- Virginia

- Washington

- Washington DC

- Wisconsin

- Wyoming

Federal Taxes

To compute your federal taxes, you will need to know your Adjusted Gross Income, Tax-exempt interest, and Social Security benefit amounts.

Adjusted Gross Income (AGI) is a measure of an individual's total taxable income, calculated by taking the person's gross income (which includes all income from wages, salaries, investments, and other sources) and then subtracting certain allowable deductions, such as contributions to retirement accounts and certain business expenses. AGI is used by the Internal Revenue Service (IRS) to determine an individual's eligibility for certain tax deductions and credits, as well as their tax liability. AGI is reported on line 11 of Form 1040, the standard individual income tax return form used by most taxpayers.

Note that your final AGI includes the taxable portion of your Social Security Benefits, line 6b of Form 1040. The formula for calculating the taxable portion uses the AGI minus the line 6b part, so as an input AGI does not include social security.

Tax-exempt interest is interest income that is not subject to federal income tax. This can include interest earned on certain types of investments, such as municipal bonds, as well as interest income from certain life insurance policies. Non-taxable interest is reported on on line 2a of Form 1040. Tax-exempt interest is not added to Adjusted Gross Income (AGI), but it will be added back in for the purposes of computing the taxable percentage of Social Security Benefits.

The Social Security benefit amount is simply the amount of money received from the SSA over the course of the year.

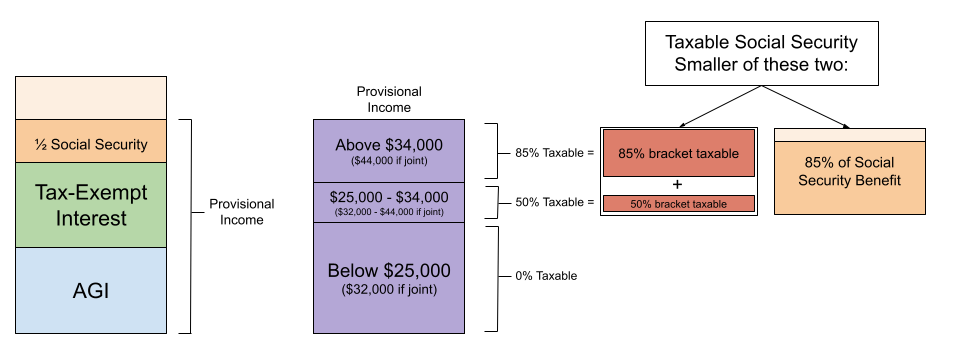

With these 3 numbers in hand, one can calculate the portion of Social Security subject to federal taxes. The following infographic shows the steps, which we will then go through in detail.

(Relative size of the boxes will differ in your situation)

The first step is to calculate a number called "Provisional Income" (PI). Provisional Income is your AGI (less taxable Social Security) with a few things added back in. Add to the AGI any Tax-exempt interest and 1/2 of your total Social Security Benefits.

Provisional Income = Adjusted Gross Income (AGI) before Social Security

+ Tax-exempt interest

+ 1/2 of total Social Security Benefits

For example, if your AGI was $30,000, Tax-exempt interest of $1,200 and $16,000 Social Security, your Provisional Income would be $30,000 + $1,200 + ($16,000 / 2) = $39,200.

Single Filer Calculation

For a single filer, use break points of $25,000 and $34,000.

If your provisional income is less than the first break point, $25,000, none of your Social Security Benefits are federally taxable.

Any provisional income between $25,000 and $34,000 is federally taxable at 50%. If your total provisional income is between these two points, calculate the federally taxable amount as (PI - $25,0000) x 0.5.

Any provisional income above $34,000 is federally taxable at 85%. If your total provisional income is above $34,000 these two points, calculate the federally taxable amount as (PI - $34,0000) x 0.5 + $4,500. The $4,500 number is 50% of the the provisional income between $25,000 and $34,000.

At most 85% of your Social Security Benefits are taxable, so if the above formula produces a result that is greater than 85% of your Social Security Benefits, then exactly 85% of your Social Security benefits are taxable.

Joint Filer Calculation

For a joint filer, use break points of $32,000 and $44,000.

If your provisional income is less than the first break point, $32,000, none of your Social Security Benefits are federally taxable.

Any provisional income between $32,000 and $44,000 is federally taxable at 50%. If your total provisional income is between these two points, calculate the federally taxable amount as (PI - $32,0000) x 0.5.

Any provisional income above $44,000 is federally taxable at 85%. If your total provisional income is above $34,000 these two points, calculate the federally taxable amount as (PI - $44,0000) x 0.5 + $6,000. The $6,000 number is 50% of the the provisional income between $32,000 and $44,000.

At most 85% of your Social Security Benefits are taxable, so if the above formula produces a result that is greater than 85% of your Social Security Benefits, then exactly 85% of your Social Security benefits are taxable.

Last word

It is important to understand how federal taxes and social security benefits interact and how they can impact your finances. By using the formulas and information provided in this guide, you can better understand your own tax situation and make informed decisions about your benefits. Keep in mind that taxes and social security benefits can be complex, so it may be helpful to consult with a tax professional or the Social Security Administration for more information and assistance.